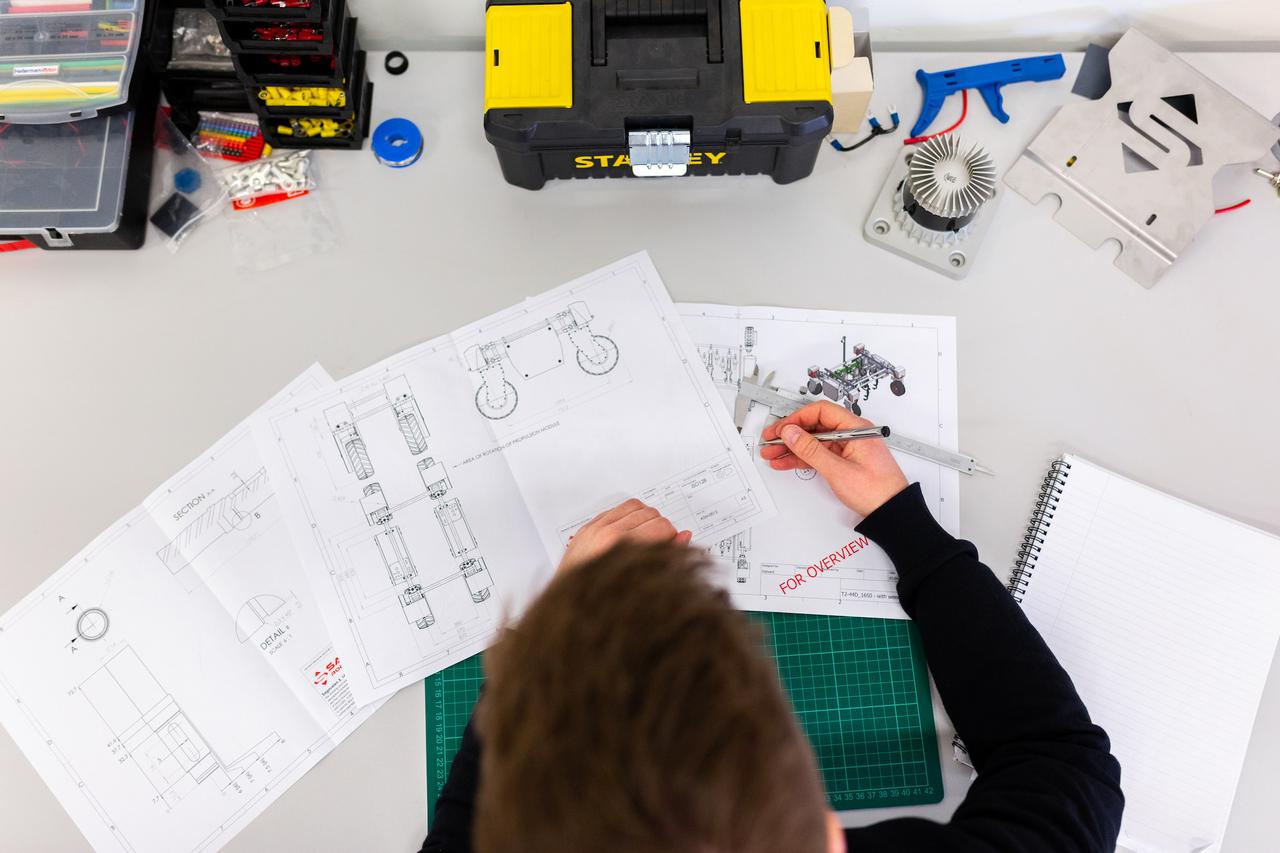

The importance of business insurance in all industries is undeniable, and engineering firms are no exception. Every business has unique needs when it comes to risk management, and standard insurance policies may not always cover them adequately.

This issue is especially true in engineering, where work can be intricate and complex, with a high degree of responsibility and associated risks.

Traditional business insurance can fall short, but working with a full-service insurance brokerage provides comprehensive protection. Here are five ways custom engineer insurance delivers value.

Policy analysis and contract review

Understanding the intricacies of insurance policies can be a daunting task. Working with an insurance broker, you have an expert to conduct thorough policy analysis to ensure your engineering business is covered. They can also help to clarify the implications of your current policy and suggest modifications through custom coverage.

Contract review will help you identify potential risk areas and ensure that liability is equitable between all parties. These services often go beyond insurance, covering any agreements related to your projects. Investing time in meticulous inspections of your contracts can help you understand potential liability issues and practice risk mitigation.

Risk analysis

The engineering field is diverse, and the risks can vary significantly depending on a company’s specialization. Risk analysis considers factors such as:

- Project size

- Complexity

- Location

- Potential legal challenges

The analysis allows brokers to understand the complexities facing a business and provide VIP customization for coverage that aligns with your specific needs.

Following a comprehensive risk analysis, an insurance broker creates a risk profile unique to your business. This profile guides the creation of an insurance policy to accommodate risks and their potential impact on your operations. A personalized and holistic approach ensures engineering firms are safeguarded against all possible risks.

Professional liability insurance

The engineering profession requires a high level of expertise and precision. Despite best efforts, errors can occur, and when they do, the financial implications can be overwhelming.

Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, offers coverage for such situations, protecting your firm against claims of negligence or failure to perform professional duties.

E&O coverage is designed to shield engineers from unanticipated risks, providing financial support for:

- Defense costs

- Settlements

- Judgments

Workers’ Compensation

Engineers often work in environments where accidents can occur. Workers’ Compensation insurance ensures employees are covered in case of work-related injuries or illnesses, providing them with the security they need to work with confidence in any situation.

Beyond just fulfilling legal requirements, a robust Workers’ Compensation plan reflects your commitment to employee safety and well-being.

Customizing this insurance product protects your staff and helps a company to attract and retain top talent in the engineering field. At villaNOVA, we tailor these policies to match the specific risks associated with your business activities.

Cyber liability

Engineers heavily rely on technology for their work in today’s digital age, which creates a risk of cyber threats. Cyber liability insurance covers financial losses from data breaches, including costs generated from:

- Data recovery

- System repairs

- Legal fees

- Reputation management

A cyber-attack can have severe consequences, whether sensitive client data, proprietary designs, or essential operational systems. Having protection and resources to overcome those consequences provides confidence and peace of mind as you operate and grow your company.

Contact villaNOVA Insurance Partners with questions about insurance products for engineers.

Insurance is not a “one size fits all” matter. Engineers, with their unique needs and risks, require tailored solutions.

At villaNOVA Insurance Partners, we understand this and are ready to work with you to provide VIP customization for your insurance products. If you have any questions or are unsure what type of insurance is right for you, reach out to our team. We provide comprehensive protection so your business isn’t exposed––no matter what. Contact the villaNOVA team today.